Update on ESG ratings regulation in the UK and EU

In recent years, regulators in the EU and UK have moved to bring ESG rating providers in scope of regulation, aiming to increase transparency, comparability and trust in ESG ratings. Both jurisdictions will require ratings providers to seek regulatory approval to operate and propose similar yet different frameworks to achieve increase transparency and integrity in the sector. Under both regime, the onus lies with the ratings provider rather than the end-user.

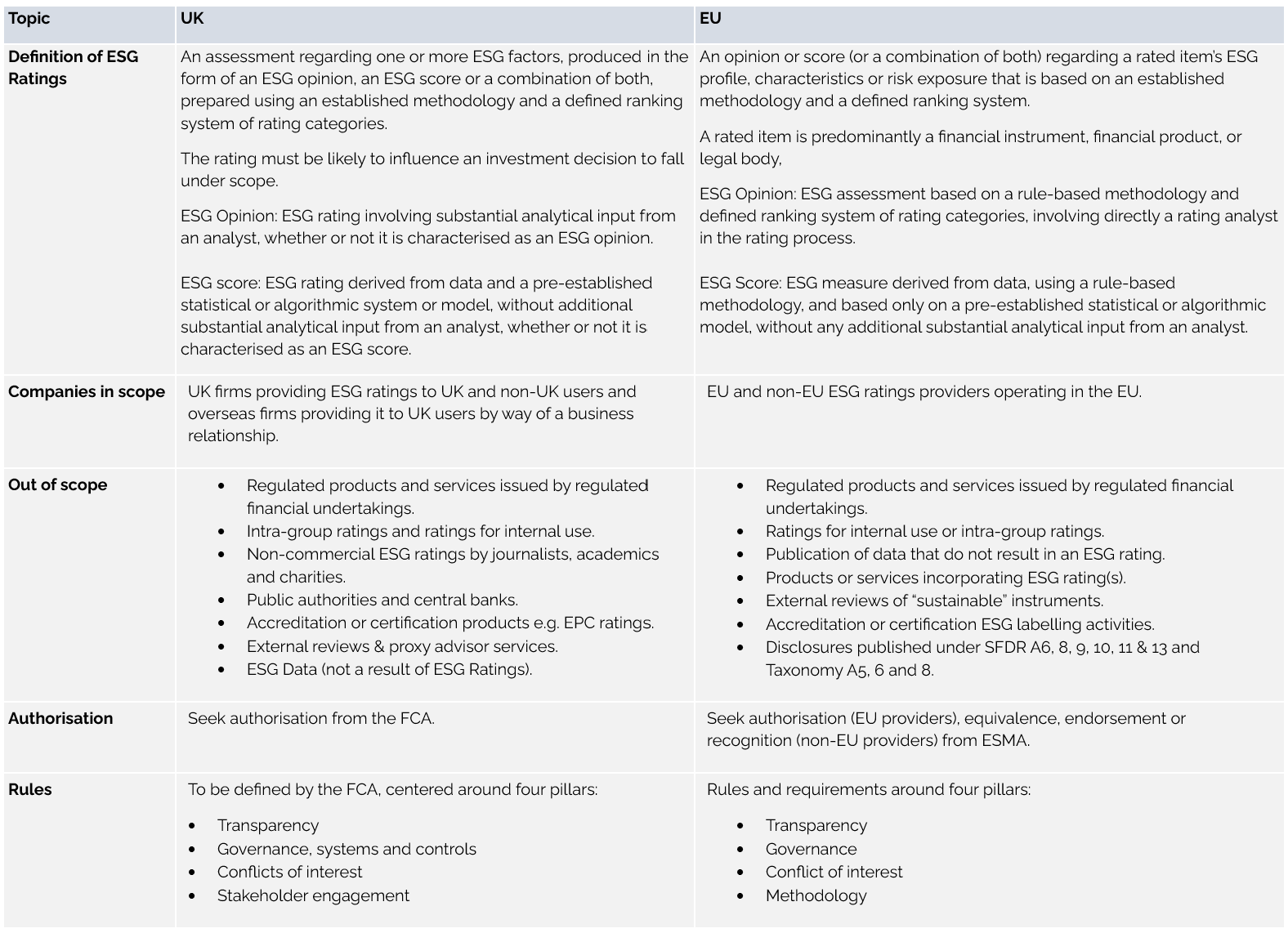

In general, ESG ratings providers complying with one regime are likely to comply with the other, however, the application process and requirements will be different, as summarised below.

The UK: FCA’s Proposed ESG Ratings Regime

In December 2025, the Financial Conduct Authority (FCA) launched a consultation on draft legislation to regulate ESG rating providers under the Financial Services and Markets Act 2000 (Regulated Activities) (ESG Ratings) Order 2025. At this stage, the consultation remains live and the proposed framework is subject to change.

Under the proposed regime:

The regulation applies to firms that produce and make available ESG ratings likely to influence investment decisions, a key distinction from the EU’s scope. Ratings providers solely distributing ratings are excluded.

ESG rating providers providing ratings in the UK will need seek FCA authorisation to operate and fulfil minimum requirements as listed below.

Ratings providers need to evidence compliance with a principles-based framework built around four pillars, aligning with IOSCO recommendations:

Transparency: Minimum public disclosures at provider and product level.

Governance, systems and controls: Evidence of robust oversight, quality control, data validation and methodology reviews.

Conflicts of interest: Requirements to identify, manage and disclose conflicts of interest at organisational and personnel level.

Stakeholder engagement: Standards for fair engagement, including feedback mechanisms and data accuracy checks.

Timeline:

Consultation runs until March 2026.

Authorisation gateway opens June 2027.

Regime goes live June 2028, with a one-year transitional period.

The EU: ESMA’s ESG Ratings Regulation

The EU introduced its first ESG ratings framework in December 2024 through the Regulation on the Transparency and Integrity of ESG Rating Activities (ESGR). ESG rating providers must apply to ESMA for authorisation to operate in the EU.

The regulations apply to ESG ratings providers established in the EU and non-EU entities that issue and distribute ratings in the EU. Providers must both issue and publish or distribute ESG ratings. Distributing a third party’s ratings does not bring entities into scope, as is the case in the UK.

All in-scope ratings providers need to seek authorisation from ESMA, or if operating from outside the EU, seek an equivalence decision with the relevant regulatory body.

Compliance covers the following areas:

Governance: Disclosure on business structure, governance information including organisational charts and information on ratings analysts.

Transparency: Disclosure on ESG rating procedures, methodologies, models, key assumptions and data sources, including how non-public information is collected and explanation of any deviations from standard approaches.

Conflicts of interest: Restrictions on ownership and provision of staff providing other activities e.g., consulting, credit rating, audit, investment, insurance and benchmarks. Disclosure is required on policies and controls to minimise conflicts of interest, as well as any identified conflicts of interest.

Methodology: Ratings must follow a rigorous, documented methodology, incorporate reliable data sources, be regularly reviewed and reflect market and regulatory developments.

Timeline:

Regulation entered into force January 2025.

ESMA published technical standards in October 2025.

Rules come into effect in July 2026 after an 18-month transition.

For more information on this topic and how the regulations may impact your firm, get in touch.