PRI’s 2026 Reporting Framework Arrives: Leaner structure maintains signatory input and effort

The PRI’s new reporting framework is here, delivering on their promise to reduce the number of questions signatories are required to report each year. While the number of indicators has been reduced, the framework remains comprehensive and, for the first time since 2023, reporting is mandatory for all established signatories.

What has changed?

The PRI has streamlined the framework, consolidating questions to reduce duplication. The new reporting framework, whilst undeniably shorter, in fact references 55 of the previous framework’s indicators and introduces 6 entirely new ones. The removal of asset class-specific modules is a notable change, with content now integrated into broader modules on investment analysis, decision-making, and stewardship.

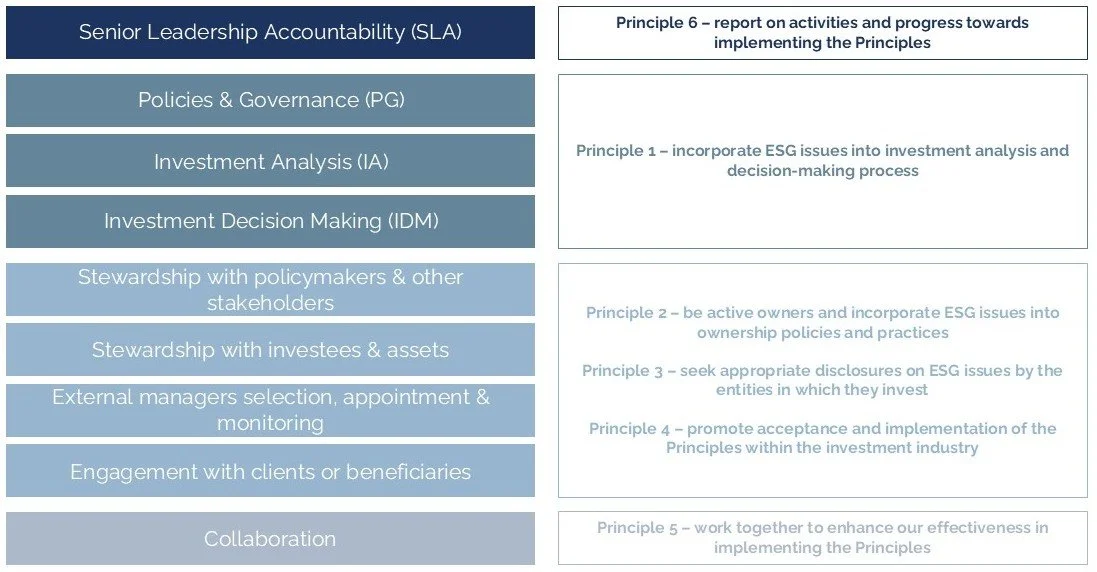

Partial reporting, which was permitted in 2024 and 2025, is no longer an option. All signatories must now respond to approximately 40 indicators covering:

Senior leadership accountability

Policies and governance

Investment analysis

Investment decision-making

Stewardship with policymakers and/or other stakeholders

Stewardship with investees and/or assets

Engagement with external managers (as applicable)

Collaboration

Engagement with clients and/or beneficiaries

Each of the 6 PRI principles is addressed by the new framework, allowing signatories to demonstrate their membership commitment.

Signatories will continue to receive the same reporting outputs as in previous years:

A Transparency Report (now only available in full to those logged into the data portal)

A private Assessment Report, with star ratings across 3 modules:

Policies, governance & disclosure,

Selection, appointment and monitoring of external managers

Investment practices (a star rating will be given per asset class).

Expanded Scope and New Expectations

The new reporting framework refocuses around the PRI’s own strategic priorities and their role in convening investors to support progress on RI topics. Human rights, nature and collaboration all feature more prominently than they did in the previous framework.

Human Rights: Once voluntary and unscored, human rights questions are now mandatory. Signatories must explain how they conduct due diligence, monitor risks, engage stakeholders, and enable access to remedy.

Nature: Signatories are asked whether they have specific investment guidelines on nature, whether they consider sustainability outcomes connected to nature, and whether they assess financially material risks and opportunities connected to nature.

Collaboration: Collaboration also features prominently with signatories being asked whether they work with other investors to achieve their responsible investment objectives and to provide examples of how they do so.

In addition, signatories are now asked to provide examples of responsible investment activities, including where they have identified material sustainability issues and conducted stewardship activities. However, the reporting requirements on public disclosure have been scaled back. PGS 3 which previously required signatories to specify which elements of their Responsible Investment policy were publicly available, is no longer scored. Additionally, PGS 19, focused on the public disclosure of trade association memberships and support, has been removed entirely.

Organisational Overview & Hedge Fund Complexity

It remains unclear how signatories will report on what used to be included in the Organisational Overview module (i.e., the nature and breakdown of their assets) as this wasn’t included in the framework released by the PRI. We expect additional questions to be introduced to cover at a minimum:

Total AUM

Asset class breakdown

Internal vs external management

Active vs passive strategies

Hedge fund signatories face a particularly notable change: they must now disaggregate assets previously reported under the “Hedge Fund” module into underlying asset classes. For investors with complex structures, this could prove challenging in itself.

Looking Ahead: PRI Pathways

Launched alongside the PRI’s new website, PRI Pathways organises the PRI’s guidance into the promised pathways, pillars and practices, helping signatories navigate sustainability integration. There is likely more to come from the PRI on this, in particularly around the PRI’s promise that signatories will be able to voluntarily report their progress through their chosen pathways. We anticipate that much of the granular, asset class specific information requested in previous years will form the building blocks of Pathways reporting.

Preparing for 2026

Although the framework is leaner, the reporting lift remains substantial. With structural changes likely to eliminate efficiencies such as pre-filling, early preparation will be key. Signatories should begin by reviewing the new indicators and identifying gaps.

We support PRI signatories with gap analysis exercises, mock assessments, peer analysis and fully outsourced reporting - saving significant time and resource for our clients.

Ready to prepare for 2026? Get in touch to explore how we can support your reporting journey.